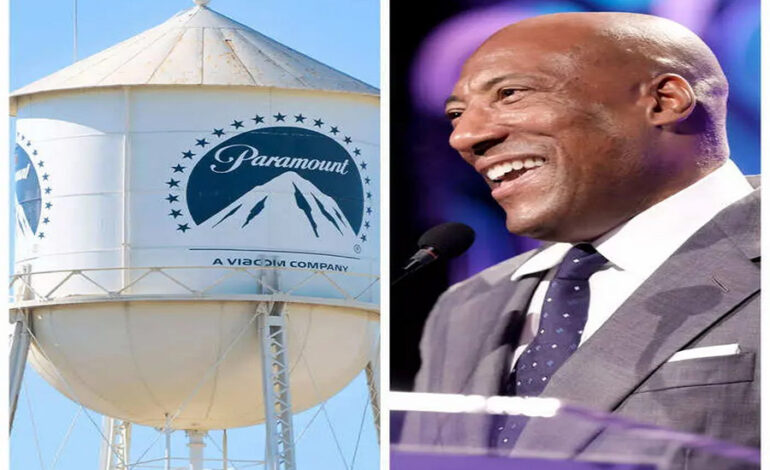

The Curious Case of Paramount’s Potential Acquisition: A Closer Look

A Bold Bid

Media entrepreneur Byron Allen has made headlines with his ambitious bid to purchase Paramount, the renowned media conglomerate boasting assets like CBS, MTV, Comedy Central, and a prestigious movie studio. Allen Media Group has proposed a staggering $14.3 billion acquisition, eyeing Paramount’s vast portfolio of entertainment properties. However, despite the buzz surrounding the offer, Wall Street remains skeptical, casting doubt on the feasibility of the proposed deal. Analysts question whether Paramount’s true value justifies such a hefty price tag, with many investors unconvinced by Allen’s ambitious bid.

Skepticism Abounds

The announcement of Allen Media Group’s bid for Paramount sparked a flurry of speculation, but market sentiment remains cautious. While Paramount shares experienced a brief uptick following the news, investors remain unconvinced of the company’s valuation. Wall Street estimates suggest that Paramount’s intrinsic worth falls significantly short of the $14.3 billion figure proposed by Allen, raising doubts about the likelihood of the deal materializing.

Byron Allen’s Track Record

Much of the skepticism surrounding Allen’s bid stems from his track record in the industry. Despite his reputation as a media entrepreneur, Allen’s previous attempts at high-profile acquisitions have faltered. Past endeavors, including bids for ABC, BET, and the Denver Broncos, have failed to materialize, leaving some investors wary of placing confidence in his latest proposal. Questions regarding the feasibility of financing the Paramount acquisition further compound doubts about Allen’s capacity to execute such a monumental deal.

Industry Challenges

Beyond the uncertainties surrounding Allen’s bid, Paramount finds itself grappling with broader industry challenges. The evolving landscape of media and entertainment, marked by the rise of streaming platforms and the decline of traditional broadcast and cable TV, has placed immense pressure on companies like Paramount. As the industry undergoes a seismic shift, media companies are forced to navigate turbulent waters, with many facing declining valuations and uncertain futures.

The Road Ahead

While Paramount’s fate remains uncertain, the prospect of acquisition continues to loom large. Recent reports suggest that other potential buyers, including David Ellison, a prominent movie producer, have expressed interest in acquiring the company. However, the discrepancy between Allen’s valuation and market expectations remains a point of contention. As Paramount’s share price fluctuates amidst acquisition rumors, industry analysts and investors alike await further developments, eager to decipher the outcome of this intriguing saga.

In conclusion, Byron Allen’s audacious bid for Paramount has thrust the media conglomerate into the spotlight, igniting speculation about its future. While the proposed acquisition promises significant implications for both Paramount and the broader media industry, lingering doubts and uncertainties cast a shadow over the feasibility of Allen’s ambitious endeavor. As the saga unfolds, stakeholders remain poised for further revelations, anticipating the resolution of this captivating narrative in the world of media and entertainment.